|

Getting your Trinity Audio player ready...

|

Blog Synopsis: Banking firms are turning the tables in the finance sector by adopting technological reforms. Your financial company can also gain benefits just as online banking apps like Chase do these days. Accordingly, it has set a high benchmark in the banking and fintech market. You can also make an app like Chase by following the right approach mentioned below. Therefore, read this article carefully and start your banking app development!

The banking and financial institutions are safe and scalable entities today. People trust them and keep their money in the bank. Accordingly, banks also give investment and other financial benefits options. To reach a wider audience, banks should extend their boundaries from local branches to mobile phones. However, it allows you to achieve higher business goals like Chase Bank.

Recent reports from the bank have issued a prediction for net interest income of $90 billion in 2024. Moreover, it implies that JPMorgan Chase will top consensus expectations for $86.5 billion. Well, the millennials and Gen Z, prefer to use online banking apps like Chase has. So, you should also create your banking app.

To make a robust app, you need to hire mobile app developers. Along with that you also need to know other related solutions. So, the article will help in concept clarity to build a unique banking app.

What is a Chase Mobile Banking App & how it works?

Chase is a commercial banking enterprise that originated in the USA. It is a secure and reliable banking solution offered on physical and online branches. Being an emerging financial institution, Chase manages multiple financial operations for its customers.

JPMorgan Chase & Co. has established Chase as the multinational banking and financial service provider for users. In addition to that, Chase is the biggest banking firm with $2.6 trillion in assets and operations globally. The branches of Chase Bank are widely available in all the US states. So, you can find the location and commute to your nearby branch for specific transactions that require a branch visit.

Besides that, the Chase mobile app is handy on your phones for any financial and banking operations to perform online. The Chase app has 10M+ downloads on the Play Store and 4.8 ratings on Apple Store. Because it is a widely used app to handle banking transactions smoothly from anywhere.

Moreover, it is a great inspiration for other financial and banking firms to develop an online presence. Your online banking app like Chase will allow your business to expand its target audience.

On the contrary, many traditional banking firms assume fintech app development is costly. But, it’s not correct, your banking app will even have a range of monetary sources. Furthermore, to get a better overview, here are various revenue models for banking apps like Chase.

How do Online Banking Apps Like Chase Make Money?

The physical banking branches that you might have, give pretty good income streams for your bank. Well, the major earning sources of banks are consumer banking, investment banking, commercial banking, wealth management, and so on.

Having an app installed on the customer’s phone will keep your banking services available in a few clicks. Thus, your mobile banking app like Chase’s business model portrays major streams of money through your banking app.

-

Transaction fees

Your online banking application like Chase can earn huge revenue through transaction fees. However, it is a minimum that banks charge on their payment gateways and for each online transaction.

-

Subscription Charges

The subscription-based model allows customers to upgrade their accounts and access premium banking facilities. So, it is another good source of income with a loyal customer base.

-

In-app promotion

You can make money by promoting the services of third-party businesses. It is a sort of marketing of other firms on your app. Hence, you can gain commission on promoting their business.

Furthermore, it is crucial to strategy your app like Chase’s business model. So, you can consult mobile app developers to get a better understanding. Now, moving to the features of banking apps like Chase.

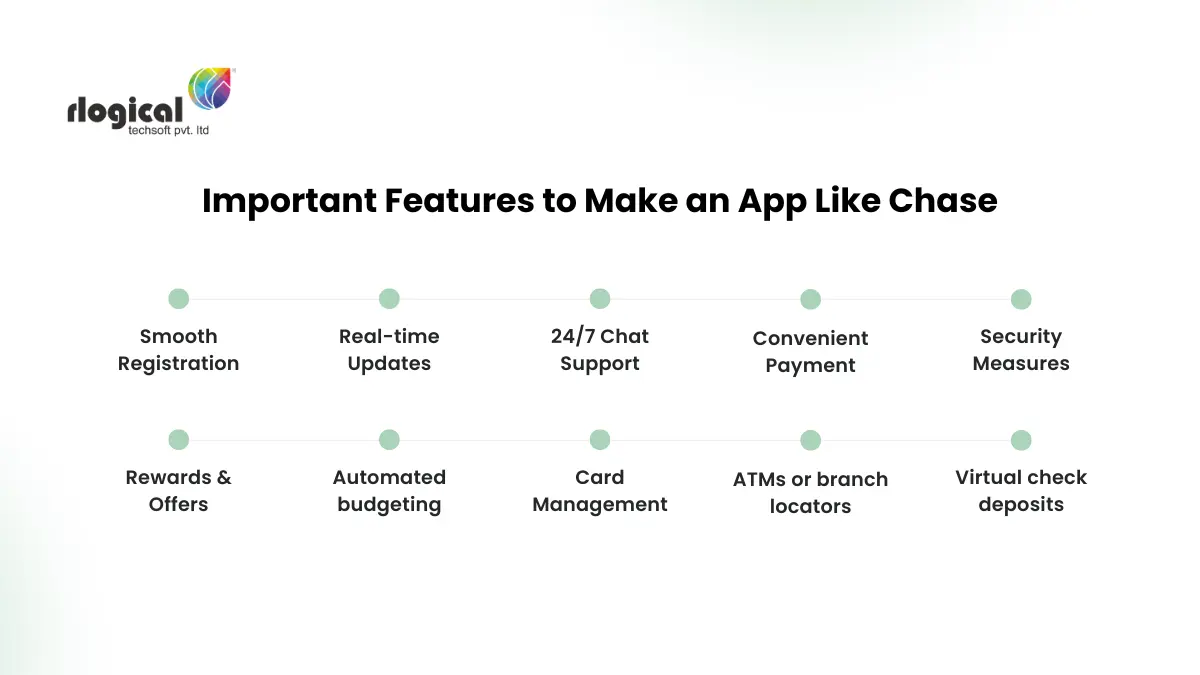

What are the Important Features to Make an App Like Chase?

Building an app like Chase must have key features to deliver a streamlined user experience. Here the features set are categorized based on various app parameters. So, let’s dive into the banking app features from basic to advanced.

Core Mobile Banking App’s Features

-

Smooth Registration

The basic and vital feature of any banking app is creating a user profile. Every new visitor can easily register for an account with a username and password. Hence, it is the first step to unlocking and using the banking facilities of the Chase-like banking app.

-

Account Management

Build an app with the primary need of users to control their money efficiently. The app dashboard must encompass quick account balance checking, transaction history, and money movement with filters for time duration. It’s the most essential and common requirement of mobile banking app users.

-

Send/Receive Money

Sending and receiving money online via the app is the must-have feature in any banking app. So, online fund transfer needs to be an easy process.

-

QR Code Payments

The new-age payment solution allows customers to pay merchants by scanning the QR code from the banking app. Thus, it has been used as the contact-free payment method integrated into your Chase-like banking app.

User Interaction-Focused Features

-

Real-time Updates

Your banking app like Chase must have a feature to notify the users on a real-time basis. In general, a banking app sends alerts on cash deposits and withdrawals. So, you will remain aware of every activity on your account.

Moreover, you can customize this feature for users enabling them to get notifications on certain things only. Thus, it delivers a better user experience through your banking app.

-

24/7 Chat Support

Allowing users to connect with support staff for any issue is essential. Your online mobile banking apps like Chase must provide quick chat assistance for users. It gains customers’ loyalty by solving their concerns at any point in time. So, it is a must-have feature in your banking app.

-

Convenient Payment

The payment gateways for customers should be seamless and protected in your banking app. You can integrate payment methods like digital payments, debit cards, credit cards, Buy now, pay later (BNPL) options, etc. Thus, your app provides alternative payment methods to users.

-

Security Measures

Building a banking app with power-packed security solutions is crucial and inevitable. However, the banking and finance sector has robust security patches to save users’ data and protect them from malware. There are various security options you can use for your app. For instance, two-factor authentication, biometrics, and other cybersecurity measures.

-

Rewards & Offers

To retain user engagement for a longer time, your banking app solution must deliver attractive rewards. Additionally, it offers customers vouchers and cashback on merchant payments along with credit card deals. Thus, customers enjoy such discounts or deals while using bank apps for payments. As a result, it leads your mobile bank app to get higher repetitive customers.

-

Investment Tracking

Your banking app permits users to manage investments in a centralized manner. It keeps track of the stock market and provides valuable insights to users for improving their portfolios.

Features to Optimize User Experience

-

Instant Accessibility

To make your app easily accessible to users with disabilities, you need to integrate voice and face recognition solutions. Therefore, it will assist users in managing the account operations from their mobile devices.

-

Personalized layout

Offering personalized app features like putting nicknames or saving the account details, changing the home screen background, etc. As a result, such functionality increases users’ experience with your app.

-

Improved Performance

A high-end performance in the banking app is anyways essential to handle the process speedily. Fast loading time and quick analysis of transactions are a few needs to be met within seconds. Hence, the better-performing banking app has increased the potential to train users for a longer time.

Advanced Features to build an app like Chase

-

Automated budgeting

Using automation, you can offer personalized budget planner by tracking their spending. Hence, it will help users to keep a check on their day-to-day transactions in a systematic format.

-

Card Management

The card management functionality of an online banking app like Chase gives access to handle cards effectively. So, you can simply block or unblock your debit or credit cards. It is the proper solution to prevent card-related transaction risks.

-

ATMs or branch locators

The in-app feature of finding nearby ATMs or your banking branch is a core necessity for local customers. It allows them to use the app and locate the ATMs for instant cash withdrawals. So, your banking apps like Chase are built with map integration with a network of bank and ATM branches.

-

Virtual check deposits

This is an interesting feature that enables users to click pictures of the front and back of a check and upload them to the app. Therefore, using your mobile phone you can manage to deposit checks without visiting the branch.

So, these are all the major features you can’t neglect to develop your banking app like Chase. Now, let’s learn the steps to make a remarkable banking app.

How to Build a Mobile Banking App like Chase?

-

Write down your business needs

The very first step to getting started with your fintech app development is having a clear concept. Your banking or finance app requires prior planning of the allocation of resources. Analyzing the market and accordingly building your business plan is critical. Hence, it will keep a record of how the process should be done and things to consider.

-

Prepare app wireframe and prototype

Next, you have to design the wireframe of your online banking app like Chase. Because it gives a complete blueprint of app design elements and screens. As a result, you also decide on the font, color, theme, and templates of the app.

Furthermore, to get validation of your app idea, you should develop an MVP app. It can be created with low-code or no-code platforms to know the accuracy of your banking app. So, based on the feedback of MVP you can better strategize your further process.

-

Choose Technology Stack

For the features-packed app, you have to consider the relevant technology stacks. So, it can be easily understood with the below table:

| Android | iOS | |

|---|---|---|

| Programming languages | Java or Kotlin | Objective-C or Swift |

| Tools | Android Studio | Xcode |

| Database Management Tools | MySQL | SQLite |

| Payment Integration | Google Pay | Apple Pay |

| Maps Integration | Google Maps | Apple Maps |

These are some of the prominent and popular tech stacks to develop online banking apps like Chase. Moreover, you can get custom app solutions when hiring Skilled Flutter App Developers. Flutter helps various industries to accomplish their business goals. As a result, you can also target Android and iOS platforms using Flutter.

-

Hire Fintech App Developers

Hiring the right app developers for your project is essential to develop a robust banking application. Thus, you must conduct market research and partner with a fintech mobile app development company. Ensure to perform interview rounds of developers before finalizing them. So, you can get a dedicated development team for your project.

-

Execute the development cycle

After having the team of app developers, you can move to the actual development phase. It will include coding, frameworks, database tools, third-party integrations, etc. So, you have to keep control of the task flow to get timely project delivery.

-

App Testing & Deployment

For mobile online banking apps like Chase, you have to perform thorough testing and quality assurance. Thus, it can be managed to conduct parallel with the development stage as well. But after the complete app development, testing and debugging the errors is important. Hence, it refines your banking app and fixes bugs.

Your online banking app is ready to launch on the appropriate platforms. So, now the users can install the app and use your banking services online.

-

Timely Maintenance & Support

Lastly, your fintech app demands regular maintenance and updates. Either with new features or security compliance, your app needs to stay up-to-date. It can be efficiently well-maintained by the app developers. Thus, you don’t need to worry about the after-app deployment solutions. Because if you hire app developers from us, you can rest assured in this regard.

So, your Chase-like banking app development will remain hassle-free, if you follow the above steps. Now, you must be curious about how much does it cost to develop an app like Chase. Here you go!

What is the Cost to Develop Banking Apps Like Chase?

The cost to build a banking app like Chase majorly depends on the cost-influencing factors which are;

- App Size

- Developers’ hourly rate

- Platform Fees

- Technology Stack

- Country of development company and other factors.

Additionally, your performance-rich banking mobile app development project requires an overall budget of $30,000 to $250,000+. It might increase with the modern-age technological solutions. On the other hand, you can reduce your app development cost. Hence, if you outsource app development services to Rlogical, your fintech app will become more cost-effective.

Create Your Powerful App to Surpass Chase’s Mobile Banking App

Although Chase has been considered a great example of creating online banking apps today. You must have to input your business’s uniqueness and out-of-the-box approach. Because after all, Chase is your competitor in the market. So you need an experienced team to develop your app with exceptional technological solutions.

Our app development team will undertake your business requirements and make a custom app strategy. Consequently, such a strategy will be driven by banking market standards and future trends. So, your online banking app will leverage the right mechanism of new technologies like AI/ML, Blockchain, IoT, and many more. Connect with us for your app idea and get your future-ready app in less turnaround time.

FAQ

What are the top rivalries of Chase mobile banking apps in the market?

The Chase has many leading competitors in the banking and finance market. Some of them are;

- Bank of America (BAC)

- Wells Fargo

- HSBC

- Capital One

- Citi

Furthermore, Chase holds the top position among multiple banks in the USA. It has been the correct inspiration to build your banking app like Chase.

How long does it take to build an App like Chase?

Well, there is no such specific pre-described time bound to make an app like Chase. So, your project size, features, technology stack, and other factors impact the time taken for development. Still, you can get your banking app ready within 9-12 months. However, for the exact development time, you can schedule a call with our consultant.

How can I reduce the cost of creating an app like Chase?

This is the most commonly asked and essential question. Every entrepreneur wants to reduce the cost to develop banking apps like Chase. So, the most simple way to reduce costs is IT outsourcing. Specifically, if you hire dedicated developers from India, the hourly rate will fall between $20-$25. Thus, it fits startup projects’ budget.

How can I make Mobile banking like Chase for both iOS and Android?

Building an online banking app like Chase for both Android and iOS is vital. It can make banking services accessible to vast mobile users. Moreover, it is a matter of the technology stack you choose. If you hire Flutter app developers, you can make Android and iOS apps efficiently. Hence, it gives cross-platform compatibility to your online mobile banking app.

Rahul Panchal

Rahul Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. He is a pioneer tech enthusiast who has assisted diverse enterprise solutions with a fresh perspective over the years. From integrating technologies like Full-Stack, .NET, Flutter & PHP, he has harnessed custom web or hybrid mobile app development projects. His creative outlook on the latest models of AI, ML, blockchain, and IoT, has made various businesses attain leading-edge success.

Related Blog

Categories

- All

- AI Development Services

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Rahul Panchal in Fintech

Rahul Panchal in Fintech