Blog Synopsis: The Buy Now, Pay Later is taking the online shopping trend by storm. Klarna is the reason perhaps. It offers streamlined services and focuses on customer-centric solutions. Considering Klarna as inspiration you can develop a BNPL app like Klarna. Don’t know how? This article is all about the BNPL app development solution from scratch. Read till the end to prepare an app for the 2024 BNPL market!

Over the decade and century, Sweden has bestowed many popular business brands and app solutions. Some of these have been an integral part of our mobile phones now. From H&M for clothing, Spotify, Candy Crush to Klarna, thanks to Swede for such a great range of offerings. I bet you definitely use at least any one of these, right?

Particularly for financing and online payment apps like Klarna. It has become the best buddy of the USA’s Gen Z and millennials. Around 70% of the US users are from that category.

Klarna is one of the fundamental buy now, pay later applications used for managing your purchases. The adoption of Klarna in the USA is noteworthy. A recent study predicts that Klarna will lead the BNPL payment in 2027 by generating $33.38 billion. It has surpassed the US-origin BNPL solution Affirm.

The cherry on the cake is, Airbnb, the global brand, has partnered with Klarna in May 2023. With the motive of strengthening its payment gateways for its US and Canadian users, Airbnb chose Klarna. The milestones of Klarna are astonishing, it has over 150 million users globally and partners with around 500k retailers to date.

Many new businesses consider the example of Klarna. You can enter the BNPL market with your startup idea. However, whether you are already a financial service provider, making a buy now pay later app like Klarna is fruitful. This article lets you learn how to develop and launch your BNPL solution from scratch. Also, there are some tips in the end to take the competitive edge.

What is Klarna and How Does it Work?

Klarna is a secure and scalable buy now, pay later app solution. Founded in 2005, Klarna has paved the road to success. Today, it is the No. 1 BNPL solution ruling the 2023 payment apps. It is thriving in the market for delivering a smooth user experience and has a 4.5 rating on the Play Store.

Whether you are an online shopper or prefer in-store purchasing, Klarna is convenient to make payment for any of them immediately. It splits your purchase amount into 4 equal interest-free installments. You can repay the amount afterward without any hiccups.

Klarna BNPL application is free to install on your phone. Accordingly, it is also recognized as a mobile Point of Sale (mPOS). So, you can manage your short-term financing option with just a few clicks.

Well, the best part about the Klarna app, it offers in-app stores ranging from beauty to automotive. As a result, there are about 2M daily transactions performed using Klarna. You can shop from your favorite stores anytime from your phone. Hence, you don’t need to look for shopping applications separately.

BNPL apps like Klarna provide a long list of store directories divided into categories. In addition to that, it is now accessible on your desktop with Klarna for Chrome extension. Thus, it even eliminated the concern of installation.

Apart from that, the deals and rewards of Klarna attract customers effortlessly. It allows its customers to join the rewards club for free and earn points on shopping. Therefore, Klarna grabs the majority of the attention of customers for offering seamless features.

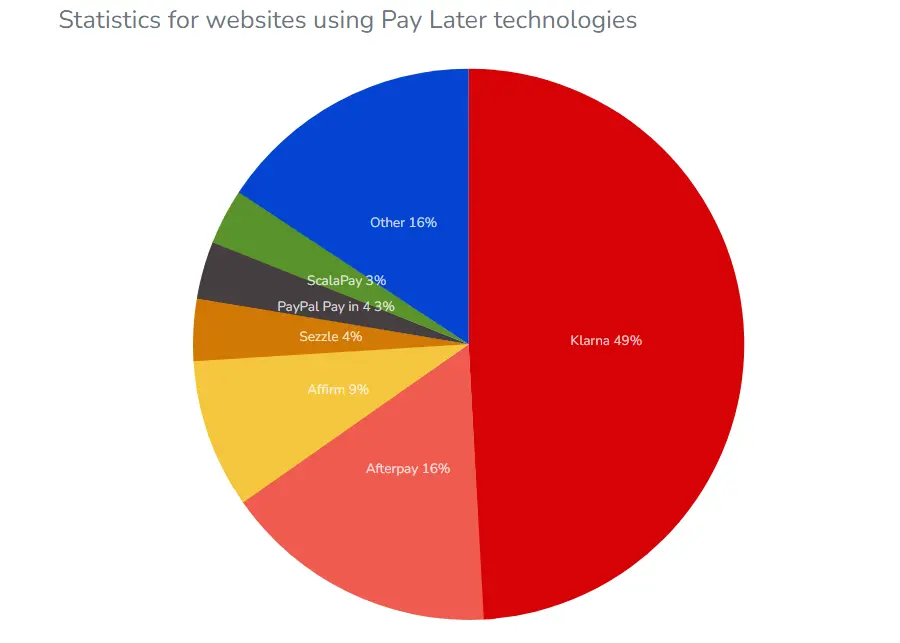

Source: Builtwith

Now, when you decide to make an app like Klarna, you must be wondering about its monetary streams. Let’s dig into it.

How Does a BNPL Solution Generate Revenue?

Earning monetary benefits is the underlying goal of any business. For starting your Buy Now, Pay Later app like Klarna, it becomes crucial to consider the sources of revenue. The market size of BNPL financing solutions has widened. So, your business will get scope and opportunities to explore many things.

However, when it comes to profit gaining, your business model of an app like Klarna is a major factor. Usually, Klarna follows a partnership and interest-based business model. It has partnered with well-known retailers and online stores. Alongside, it charges fees for late repayment to customers.

Some of the major ways to earn money in your BNPL app business are;

- Partnership Commissions

- Late payment charges

- Interest on customers’ loans

- Transaction fees

Therefore, creating a BNPL like Klarna, or better than that, has various revenue streams. Partnering with eCommerce merchants also expands your customer reach rapidly. So, there is indeed a win-win situation for you and your customers.

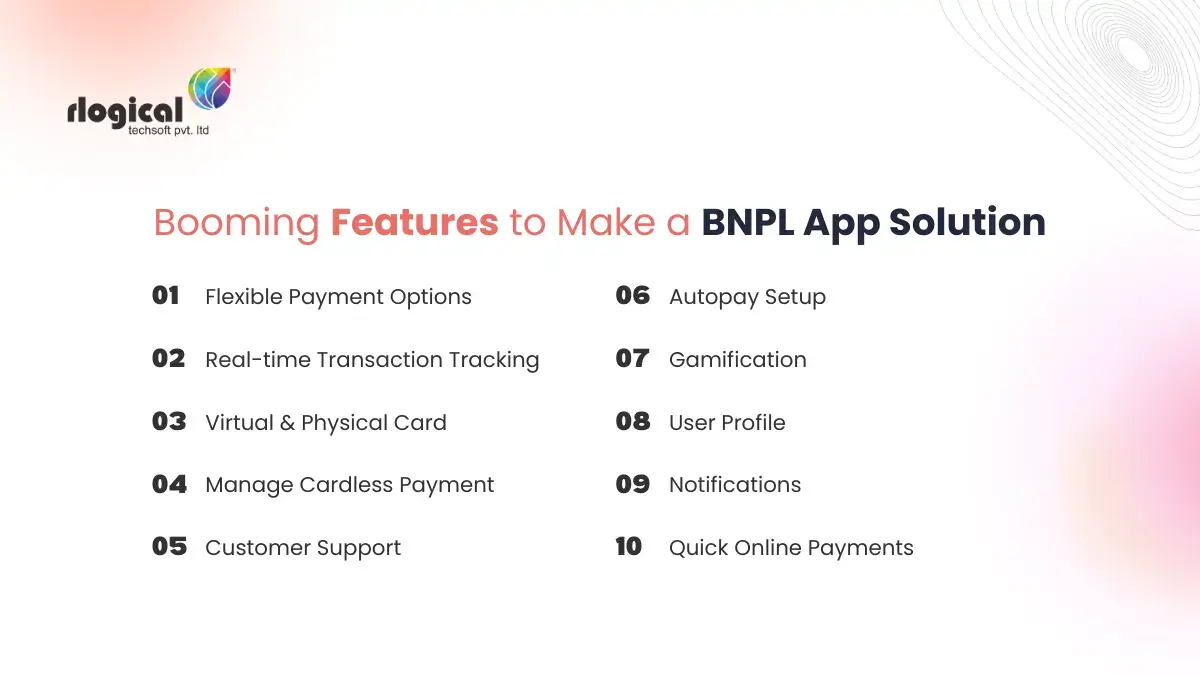

Top 10 Booming Features to Make a BNPL App Solution

-

User Profile

To build a BNPL app like Klarna, you have to make a feature-rich application. The very first feature is easy user profile registration. Klarna doesn’t ask for credit checks and get users to register with email id or other accounts. Ensure to maintain transparent and smooth registration for new users.

-

Notifications

For making hassle-free payments, Klarna notifies users about the due date and alerts them. It sends an alert for your payment status and offers on your shopping.

-

Flexible Payment options

As you get alerts for payment, the Klarna-like app should also consider offering multiple payment methods. Klarna users can easily settle their amount with their choice of payment mode.

-

Quick online and in-store Payments

You can manage your purchases instantly with a Klarna card. Be it online or in-store, just visit your store and start over with the shopping. Thus, if you develop a buy now, pay later app like Klarna with this feature, it will increase repeat purchases swiftly.

-

Real-time Transaction Tracking

Enabling real-time data tracking keeps you aware of the purchases and payments due. So, you don’t need to manually check on the transaction again and again. As you use the app, it will automatically split the payment into 4 and notify you.

-

Virtual & Physical Card

To optimize shop now and pay later for daily shoppers, offer both visual and physical cards. It is the masterstroke to captivate app and card users simultaneously. Hence, you should also consider this feature for your BNPL app like Klarna.

-

Manage Cardless Payment

Now, after providing two types of cards, to streamline the purchase, you can also make payments without cards. For mobile users, you can simply manage your shopping bills by scanning the QR through the Klarna app. Therefore, your BNPL application should adapt to such user-friendly features to create an app better than Klarna.

-

Customer Support

The next feature works like a blessing in disguise, serving the solutions to any issue of customers is what ultimately they want. Apps like Klarna must integrate 24/7 customer support. So, users connect and ask for help. You can take one step forward by implementing AI chatbots.

-

Autopay Setup

With autopay set up, your manual task vanishes. The app will fetch the bill and make payment as per your stipulated mode. You can rest assured and stress-free from any credit burden.

-

Gamification

Users like exciting rewards or deals on their purchases. So, providing them with high-end and appealing rewards or discounts on their purchase is necessary. Creating a buy now, pay later app solution like Klarna, you should really look for such a trendy aspect. It increases your chances of expanding your customer base rapidly.

How to Build a Buy Now, Pay Later App like Klarna – 7 Stages Guide

-

Analyze and strategize your idea

Begin the process of analyzing your BNPL business idea. It is a crucial step to oversee and operate your action plan with detailed research. When you study and evaluate the BNPL sectors’ market, you will gain deeper insights. So, you can prepare your do’s and don’t list for the whole app development process.

When you put things on paper, it gives you a closer picture of what the final outcome looks like. Hence, it assists in watching out for any shortcomings and taking required measures accordingly.

-

Consider Security Measures

In the cyber threat sphere, it is important to plan out the security measures beforehand. You should examine the security solutions for the BNPL app like Klarna. Some of the common security compliances to follow are two-step verification, Payment Card Industry Data Security Standard (PCI DSS) compliance, and data protection. Therefore, it is vital to make the BNPL app adhere to their regulations.

-

Create an MVP

Even though you are searching to build an application like Klarna, your main target is to stand as its competitor. For that, it is sort of mandatory to create an MVP of your application. Because it will assist you in ascertaining the recent market scenarios and customers’ behavior. Furthermore, you don’t really need any technical support for it. There are plenty of low-code or no-code MVP tools ready to help you.

-

Hire a Fintech Development Team

After executing the MVP, calculate the success metrics and move ahead to the hiring process. Searching and interviewing the appropriate candidate is most important for successful BNPL app development. The experienced app developers will reap efficient benefits for the application.

Pro Tip: It is recommended to hire industry experts such as Fintech app developers. So, the professionals will entertain the advanced solutions and improvise on the method based on your targeting industry.

-

Frontend and Backend Development

As you get the developers or a team, the app development process should commence. Frontend and backend are the primary tasks of developers to undertake. It covers the whole design, responsiveness, server-side solutions, etc. Although frontend and backend are two different verticals, you require separate developers. But the catch here is that you can also combine these expertise in one.

A full-stack developer is the one-size-fits-all sort of solution. You can get detailed information about how to hire full-stack developers from our article. So, it will minimize your task.

-

Test and Deploy the App

After the completion of development, it’s essential to test your application performance. Finding and debugging the errors before launch is a necessity. Many businesses skip this stage to reduce the cost. However, it will cost you after the launch when users face issues.

So, it’s better to be safe than sorry, get your application tested. The testing process can be automated or manual whichever method you choose. Further, it will be ready to deploy on your selected platform(s).

-

Marketing & Promotional Activities

Now, as your plan comes on the floor, you should start the practice of stealing the spotlight. It demands the incorporation of marketing and promotional activities. Digital marketing is the tactic that helps you make a global presence. You can make the most of it in the following ways;

- Performing paid marketing like Google Ads

- Social Media Marketing Strategies

- Hire Search Engine Optimization Experts

- Starting over with Email marketing

- And leveraging the Online reputation management (ORM) service

Thus, when you extensively follow these steps, it is assured to get proven results. Now, let’s move further to the technical part. You have to decide upon the best technology stack.

Read Also: How to Develop a Neobank Mobile App?

What would be the Technology Stack for the BNPL App Development Solution?

The tech stack plays a key indicator in determining the app’s overall layout and features. If you select the Android platform, the programming languages are Java and Kotlin. For iOS, there are Objective-C and Swift. However, recently the cross-platform applications’ are really hyping all around.

Especially after the emergence of Flutter technology. It works efficiently to deliver applications for both Android and iOS. You don’t need to write the codebase separately. It utilizes a single codebase for all platforms. So, you can use Flutter to make your application of Dart programming language.

Still, there are many other technologies your BNPL app development needs as mentioned below;

Programming Languages for BNPL Web Development: JavaScript, Go, Python

Multiple APIs: There is a list of APIs essential to make a BNPL app like Klarna or better than that. Let’s have a look at them;

- Payment APIs such as Stripe, Braintree

- eCommerce Gateway solution like Verifone eCommerce API

- Fraud Detection APIs are SEON and DataDome

- Banking APIs are also used to link accounts for fund transfers and repayments. Plaid is so far the renowned tool for it.

- Klarna uses the TransUnion tool for credit checking. However, you can also utilize Equifax and Experian.

Cloud Computing Platforms: Microsoft Azure, Google Cloud

Analytics Tools: Google Analytics, IBM Cognos Analytics

Third-party Libraries: jQuery, React or VueJS

So, having the right tech stack will make your development journey easygoing and accurate. It’s time to move towards the overall development cost.

What is the Average Cost to Develop an App Like Klarna?

Determining the cost of BNPL app development is a critical task. You need to look at every minute aspect before finalizing the deal. As you know, the technology stack and developers will be the decisive factor, you should also look for hourly rates of developers. For instance, outsourcing app developers from countries like the USA and the UK are expensive.

Whereas, countries like India will fit the small enterprise or startup budgets. Being an experienced app development company, we have worked on such complicated projects. So, the average cost of developing a Klarna-like app is $15,000 to $30,000.

To raise the bar for your BNPL app solution, you can also utilize advanced technology and third-party integrations. So, it will extend your offerings along with the extended cost. That would range around $20,000 or More. But the ROI of your business will be worth such an initial investment.

Quick Tips to Compete in the 2024 BNPL Sector

You have come a long way to make payment apps like Klarna stand in the global marketplace of 2024. Now, you have got an idea of Klarna’s popularity. So, you should focus on sustaining and eventually taking a lead in the industry. It can be possible by pushing your boundaries and being adaptive to the latest trends. In technology regards, consider enhancing with;

- Artificial Intelligence

- Blockchain Technology

- Machine learning

- Virtual Reality

Apart from these, you should try to experiment to merge payment cum banking services. It might sound weird, but delivering a one-stop fintech app with bank and credit payment is an innovative concept. So, it’s your turn now, remember to make the right decisions at the right time to get the desired outcomes.

Take Your First Step Now!

In a world full of technology-driven solutions, providing your BNPL service through an app solution is the ultimate choice. So, you should not waste a second, begin with the planning and execution part now. To make your research simpler, you can appoint our offshore developers. Their skill set and work portfolio will make up your mind immediately.

Jatin Panchal

Jatin Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. For more than a decade, he has been fostering the organization's growth in the IT horizons. He has always bestowed personalized approaches on .NET, PHP, Flutter, and Full-Stack web development projects. From startups to large enterprises, he has empowered them to accomplish business goals. By delivering successful industry-driven solutions, he is encouraging the capability of AI, ML, blockchain, and IoT into custom websites and hybrid mobile applications.

Related Blog

- A Complete Expert Guide on Mobile Banking App Development

- Mint is closing: Develop a Budgeting App like Mint to Attract Gen Z Users

- What is the Cost to Develop an App Like Chase - Business Model & Tech Stack

- A Guide To Understanding Fintech Software Development

- How to Build a Mobile Banking App like Chime to Boost ROI?

Categories

- All

- AI Development Services

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Grocery App Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Jatin Panchal in Fintech

Jatin Panchal in Fintech