Ever since COVID-19 emerged in the world, switching to digital modes has become prevalent. Most probably the demand for building an online entity for your business has increased. After all, it helps to accelerate your business revenue with a better customer experience. Through this, you can ace your versatility in the market.

With all the foremost technological enhancements, Mobile application development has been high in demand. The prominence of software development for banking services has been gaining attention. Today in this article, you will learn everything about banking applications, from the development criteria to futuristic features.

When we think of the banking sector, associating with queues and extremely long waits comes into consideration. But, with the rapid development of the tech-trends and the internet, banking tasks have become highly convenient and approachable for audiences. Even the potential range of banking applications has been diversifying drastically.

The global market for banking applications has been portraying good growth as most leading sectors have approached these applications to elevate their customer experience. With this wide networking of mobile applications, financial technologies have been signifying a great status in the market. So, the prolific mediums of digitalization have been influencing the banking industry to be strong and productive.

Let us give you in-depth knowledge of how to create a mobile banking app and what potential you need to incorporate into your application to make it stand out of the crowd.

How Can Mobile Banking App Development Bring Tremendous Growth In The Finance Industry?

The broadening reach of FinTech is impeccable, and in recent years this industry has been showcasing worthwhile authenticity. So, application development for this industry is a bonafide mechanism that can’t be separated.

The banking app is the ultimate solution that allows financial organizations to deliver secure, convenient, and goal-oriented results to their targeted audiences through the availability of their smart devices. Most people are highly attached to smartphones; everything is channeled through their smart screens only.

So, in this period optimizing banking applications can strengthen their trustworthiness towards you. Besides delivering a better customer experience, many major factors can elevate your interest in building a mobile banking application.

1. Better Security Measures

Nowadays, app developers are highly concerned about infusing well-versed security measures in banking applications. This way, no breaches can hinder your customers’ data and credentials. Some innovative modes are biometric authentication, auto locks, and more to generate soulful transactions without inconvenience.

2. Convenient Nature

In traditional banking, customers must go through many procedures to access their accounts. But with the emergence of banking applications, you can easily verify the performance of your accounts, money transfers, transactions, bills, and more anytime and from anywhere. Even you can groove over some banking app trends to get potential results.

3. Customer Engagement Will Be Strengthened

Through banking applications, the customer can get personalized and dealing banking operations. Moreover, the streamlined procedure of the applications makes the customers get customized solutions from the services, making them highly loyal to your organization.

4. Timely Deals

Creating mobile banking app requires working over automatic commands. So, a user doesn’t need to go through a detailed step-by-step process. Moreover, you can easily review the bank statements and transactions through one click, saving you most of your time.

5. Generate A Good Amount Of Revenues

Financial institutions can simply broaden their revenue chances through banking applications. Some efficient mediums are advertising, in-app purchase, and other diversifying monetization processes.

6. Lead The Competitive Scale

You must have seen many banking applications have been casting their reliable prominence in the market. So, you need to leverage the best categories to stay unique and convenient for the users. Hire experienced app developers to offer all the necessary technologies to help you lead the competitive scale for a long period.

Step By Step Guide On How To Create A Banking App

In the above section, we have enlightened some of the befitting mechanisms of a banking application. But, the architectural features and principles within an application get nurtured by skillful developers. You can hire genuine and experienced mobile app development services to authorize your significance in the market. Moreover, here we list the step-by-step guide to achieving a great and highly-enriched banking mobile application at your service.

-

Go Through An In-Depth Analysis And Research

Every work starts with proper knowledge about the particular objective. Likewise, when initiating the development work of a banking application, you must analyze the market and conduct in-depth research accordingly. Through this step, you can grasp a detailed orientation about the leading market trends and the requirements of the targeted customer base.

You can also approach the weaknesses and strengths of the former applications to make our innovation infuse all the necessary detailing. SWOT analysis can be the perfect criteria for research as you can identify the strategies and reliable opportunities to make your banking application proficient. Through lucrative opportunities, you must abide by the standards that will be unique and enriching for the audiences. Along with the new opportunities, you must abide by the risk factors and deflections you may face with the application.

-

Generate A Sample

Banking applications have to be dealt with care as it has many complications. Hire dedicated developers who can first generate a sample or prototype of the application as per the regarded specifications of the customer’s requirements. After acquiring the firm participation of the consumers, software developers will initiate the process. Before channeling the prototype of the application, you need to go through some exclusive research as follows:

- The product owner should be highly communicable about their needs from the application. This way, the developer can constructively measure the company’s demand and targeted audiences.

- As the banking sector has been enormously growing among the global platforms, the developer needs to curate appealing standards to make the app more engulfing for the customers.

- To make an evolving banking application, as a developer, you must understand the users’ needs and the best terms to build the application.

- Lastly, the comprehensive analysis gives rise to a simplified prototype of Mobile banking app development.

-

Construct The High-Security Measures

When a developer prioritizes developing mobile banking apps, then it is evident for them to classify the most world-class security measures to guarantee the best results. Sourcing up the security traits in the application is the most appealing feature an organization should rely upon. So, be assured of safeguarding compliance with the help of experienced app developers.

-

Give The Assurance Of Concrete UI And UX

We usually prefer the application from the app store that accesses easy processing, and the design of the layouts flares quality appeals. So, an application’s UI and UX are pivotal as they showcase your financial organization’s implementations. Through this, the functionalities and logical aspects of the application will be streamlined.

So, make your application version highly acquirable in front of a wide network of consumers. As banking processing needs a lot of details and remains credential-oriented, you need to make the user experience more valued with right clicks and pages.

-

Prefer A Reliable Tech-Stack

You should always abide by your service’s prominent goals and objectives to showcase your convenience as an organization. So, before initiating the development project, hire full-stack developers who can focus on the front-end and back-end criteria of the application.

Through this, your application can portray its engrossed utility over any digital device, no matter how diversifying the screen size is. To make your application more nurtured, you can rely upon the best mobile operating system to get your audience their satisfying results in a few seconds.

Read More: Best Tech Stack For Your Web & Mobile App

-

Now Create The Banking Application

The above steps amplify the general requirements of an application that an owner should be careful enough. After finalizing all the demands, the following developers will incorporate the functionalities to generate an application. subsequent to the app’s creation, different layers will be verified conveniently, and this verification approach will be made several times.

After finalizing the development process, the following owner should interact with the development services to fetch the right knowledge about the product. The developing team will also abide by your feedback and can make necessary changes per your orders. This way, your application’s workflow, and eminent reliability will be valued in the market.

-

Maintenance of The Launched Application

After successfully testing the application through different measures, the developers will follow up with the launching process. As the application is released into the market, the developing team will acknowledge your app with a secured IT specialist team who will eradicate the in-case issues promptly.

Depending on the operating system of the banking application, they will be channelized to App Store or Google Play, through which the customers can download and use it conveniently.

-

Necessary Improvisation And Updates Will Be Channelised

With the launch of the application, if the client’s organization develops in the market, they must optimize the app’s functionalities and update it with new features. Moreover, nowadays, startup and midsize finance app development services are at their peak due to the market’s requirements. So, you need to follow up on the banking sector trends to ace up your reach.

The above-listed steps are the fetching criteria that every development service and product owner should understand comprehensively.

What Is The Average Cost Of Developing A Banking App?

The cost of developing a banking application can diversify due to various factors. Moreover, it depends upon two major things: the time taken and developers’ hourly charges. Moreover, the cost to build a mobile banking application starts between $15,000 to $60,000 approx.

Generally, the cost varies based on the features requirements, technology stack, and the country you are choosing to outsource the service. If you prefer any top app development company, you may end up spending high costs. However, by choosing an experienced mobile app development agency from India or other Asian countries, you can crack a budget-friendly deal.

Apart from that, finalizing the accurate operating systems also affects the development cost. In current scenarios, Flutter is gaining popularity. With the emergence of Flutter 3, you can get the edge of six various platforms (macOS, Linux, iOS, Android, Web, and Windows). So, your banking app can compose the functionality of different systems. It will increase the cost somewhat around $50,000 to $250,000+.

So, it is advisable to hire dedicated mobile app developers that analyze your app needs and fit into your budget as well.

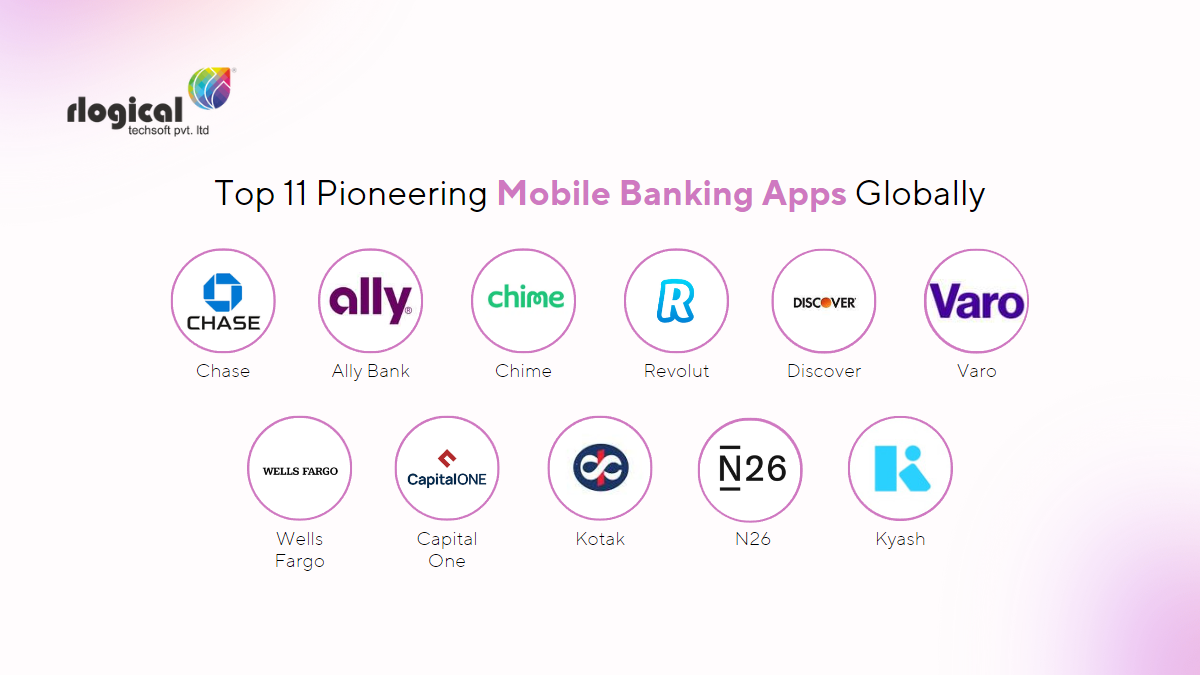

List Of Some Comprehensive Banking Applications In The Market You Should Know About In 2024

For the past few years, banking app development has been booming with great results in the market. The cutting-edge technologies of banking applications have made the usage more compelling and rigorous for users. Apart from this, the functionalities and seamless integrations have engrossed reliable measures in the market. Over the years, many convenient apps have become the audiences’ favorites. Here we list some of the best and most highly used banking applications leading the market.

-

Chase

Chase is an American-based banking solution and is categorized as one of the leading mobile banking apps for prepaid cards. Through this app, a user can conveniently reload their debit cards. Moreover, you can easily verify your accounts by getting a clear vision of your credit cards, savings, and investment options. Managing online payments through this application is highly approachable to global audiences.

-

Capital One

Capital One is a US-based tech-versed banking application that has been potentially leading the list of the favorite ones of customers. This app has a ton of functionalities that cast extreme reliability on the users. You can view your accounts keenly and manage your auto and home loans through your mobile phones. Redeeming credit cards and credit scores on this application is extremely fetching.

-

Wells Fargo

As a United States multinational financial company, Wells Fargo offers diversified banking services that meet your company’s requirements. This app allows you to invest on platforms like mutual funds and stocks. You can easily go through your trade accounts and optimize your investments through this.

-

Varo

With having established identity in San Francisco, the Varo banking application is best for optimizing your account performance through smartphones. Its user interface has been highly categorized for mobile usage. It consists of a great range of accounting tools along with money management schemes.

-

Discover

Discover is the Unites States’ popular and well-functioning banking app option. It is primarily accepted for its credit cards and helps in growing your financial status. You can go through various financial deals and planning to secure your investments. Additionally, you can save big bucks by unwinding the sales on the trendiest brands.

-

Chime

This US-based online banking app has been categorized as per the evolutionary trends of the digital era. The compelling UX and UI of the application have been streamlined with proper features. You can use this app in the form of a debit card. Here you can access funds. Get notifications for the transactions and easily set the alerts for daily balance verification.

Related Guide: Cost to Develop Banking App Like Chime?

-

Ally Bank

It is one of the foremost online banking solutions in the USA and lists among the top mobile banking applications. All banking necessities, like online bill payments, check deposits, monetary transfers, and more, will be satiated through this. The user-friendly traits of the application make it convincible for first-time users.

-

Kotak

Kotak has been a well-recognized banking institution in India. It has featured as one of the most reliable and downloaded banking applications in the past few years. It has many functionalities and features to give customers reliable accounting measures. You can easily settle bill payments and online transactions using this application.

-

N26

N26 is the banking app initiated in 2013 in Germany. Through this application, you can engulf global money transfers. Apart from this, the easy interface of the application will make you garner accessibility over cash withdrawal, investments, deposit services, and more.

-

Revolut

Being a UK-based banking application, Revolut delivers a wide range of financial services where you can easily optimize transactions within seconds. Currency exchange and money transfer can be easily done through this app. Some other enriching features of this application are budgeting tools, virtual cards, saving accounts, and more.

-

Kyash

Kyash is a renowned Fintech application based in Japan. Through this application, your financial deals will be improved. Some of the ecstatic values you can expect from this app are ATM withdrawals, offline payments, remittances, and more.

What Are The Promising Features To Be Prioritised When You Develop Fintech Software?

Here we are enlisting some of the promising features you should understand to build a mobile banking application. These core features will enlighten your positive values in the market and make your application deliver a better customer experience.

1. Availability of KYC

‘Know your customer’ is an optimistic feature every developer should understand to include in the banking application. This element will help the application garner the customers’ authentic identity and assure them of excellent security standards. Moreover, their financial transactions will be safeguarded with authorized layers. Get enhanced security and reliability by hiring banking app development experts. KYC will also help you generate quick accounts set up with all the befitting regulations and compliance.

2. Management Of The Account

The following banking application should deliver streamlined and proper account management criteria. Some effective modes you can think of are reliable balance verification, management of the accounts and cards, showcasing every transaction, and valuing the authentic results of deposits.

3. Admin Panel

It is a specialized operation that every banking application should consider. Integration of the admin panel will make it appropriate for the customers and you to access the application in a mannered way. Through this, any updates, operations, and information can be implemented in the application without any hindrances.

4. Appealing Transaction And Payment Processing

The easy and fetching transaction is somewhat every customer regards and appreciates. This is one of the must-have features that every banking application should have. Well, developing fintech software offers appealing elements that maintain transparency on working over the server side, where users will process the transaction matters. The application should portray the transaction profile in a detailed manner.

Read More: Top Fintech Trends

5. Management Of The Cards

As a banking application, you should always abide by intuitive management processing where the users’ cards will be signified properly. The screens’ interface and quality should be clear and appealing to the customers. Moreover, customers should not face any problems channeling their transactions via cards. This feature will make your application more legit, and the trust factors of the audiences will be broadened for your application.

6. Engrossing Support System

When it comes to a banking application, users go through many queries to function in the monetary exchange. You can’t hang their notions as they can lose their loyalty factor from you. So, to encounter their issues and planning, you should abide by a secured support system for your banking application.

The accessible measures of the support system should deliver 24/7 customer support and solve queries with suitable solutions. You can generate chatbots and other digital assistance to give the audience refined and tailored results within the minimum time frame.

7. Details About The Linked Bank Branches

This vital approach can systemize the user experience and deliver an authentic result to the customers. This feature will give reliable information about the bank branches’ location linked to the customer’s account. This way, they will have a keen ideology about the opening hours and the changing pattern of the system.

8. Maintain Authorization

The banking application should formulate secure measures instead of being biased by external breaches. Some of the highly entrancing security measures are passwords and fingerprints. So, along with these elements, you can engulf your login standards to make your banking applications more fetching.

9. QR Code Establishments

Establishing QR code features will enable banking applications to nurture multifunctional attributes. With the help of the QR codes, you can easily complete the payments anytime and anywhere without any negligence.

Conclusion

Well, after having detailed insight into banking applications, you can generate customer loyalty, enlarge competitiveness, broaden interaction channels, and more. So, instead of hovering over any ideas, you can hire experienced and potential application developers to incorporate the best strategies. Hire dedicated mobile app developers that facilitate the right procedure to make your banking app based on current market trends.

Would you like to learn more about us? Get in touch with us or you can check out the Clutch Profiles.

Rahul Panchal

Rahul Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. He is a pioneer tech enthusiast who has assisted diverse enterprise solutions with a fresh perspective over the years. From integrating technologies like Full-Stack, .NET, Flutter & PHP, he has harnessed custom web or hybrid mobile app development projects. His creative outlook on the latest models of AI, ML, blockchain, and IoT, has made various businesses attain leading-edge success.

Related Blog

- Mint is closing: Develop a Budgeting App like Mint to Attract Gen Z Users

- What is the Cost to Develop an App Like Chase - Business Model & Tech Stack

- A Guide To Understanding Fintech Software Development

- How to Build a Buy Now Pay Later App Like Klarna?

- How to Build a Mobile Banking App like Chime to Boost ROI?

Categories

- All

- AI Development Services

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Grocery App Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Rahul Panchal in Fintech

Rahul Panchal in Fintech