Since the beginning of the recent decade (2020), the trend of technology and innovation in industries has been upscaled. In the banking sector, Banking As a Service (BaaS) is absolutely buzzing. Although the term emerged in 2009, recently it’s gaining popularity. Due to the introduction of the Neobank mobile application, the market dynamics transformed. Now, Neobanking is far different from traditional banking.

If you are hearing about Neobanking for the first time, then let me tell you that it has already marked a powerful presence. Neobank is predicted to expand massively with a compound annual growth rate (CAGR) of 54.8% from 2023 to 2030. So, the figures suggest that it will be the future banking solution. The main aspect is that it will generate enhanced revenue in the banking sector for years to come.

There are some of the prevalent Neobank apps in the market. They are already earning big bucks. Well, you can also start with your Neobank app development. The dream of getting listed among the top Neobank apps can be accomplished.

However, setting up your Neobank app necessitates that you understand every facet of it. Keep reading to learn about the Neobanking app on how to start the Neobank app in 2024 without any obstacles.

What is Neobank in the Fintech Industry?

Neobank is the modern-age banking solution emerging as the fintech business in the banking sector. Basically, Neobank handles banking operations and account management on your smartphones. Users can utilize mobile apps or websites. So, users can simply log in to the app and open their accounts. The online KYC and documentation verify the users. Thus, it eliminates the need for a physical location or branch. You can handle every single banking operation from your location within the mobile screen only.

Nowadays, many startups are coming up with advanced and non-traditional banking solutions. Apart from that, its market size has already surpassed USD 45 Billion in 2021. Neobanking is remarkably gaining acknowledgment in 2023. It has extended the offering of banks to an entirely digital platform.

Additionally, the concept of Neobanking is booming as an efficient tool. It guides customers on budget management and savings. Neobank has been enticing customers with lower charges. So, Neobanks with potential benefits overcome the challenges for customers using traditional banks. It is undoubtedly a new fintech trend in the banking industry.

Many startups are considering Neobank and searching for how to create a Neobank from scratch. Accordingly, you need to consider the app development process and its cost. The article will clear your doubts with relevant solutions. But before that, let’s first know if the Neobank app can make you earn money or not.

How Does a Neobank App Generate Revenue Sources?

Neobanks are an entirely different concept than conventional banks. Similarly, the revenue sources are also different. Conventional banks earn through the high interest on loans and securities. But Neobank doesn’t depend on such incomes. Neobanks earn through the following ways;

- Transaction fees on each debit card swipe

- Charges on credit card payment

- Monthly subscription fees for the app

- Interest on overdrawn credit balances

With that, Neobank apps earn income in the form of fees and interest. However, it has been initiated towards the cryptocurrency and foreign exchange mechanism. These sources are not full-fledged explored. Yet have a greater scope to generate better revenue sources.

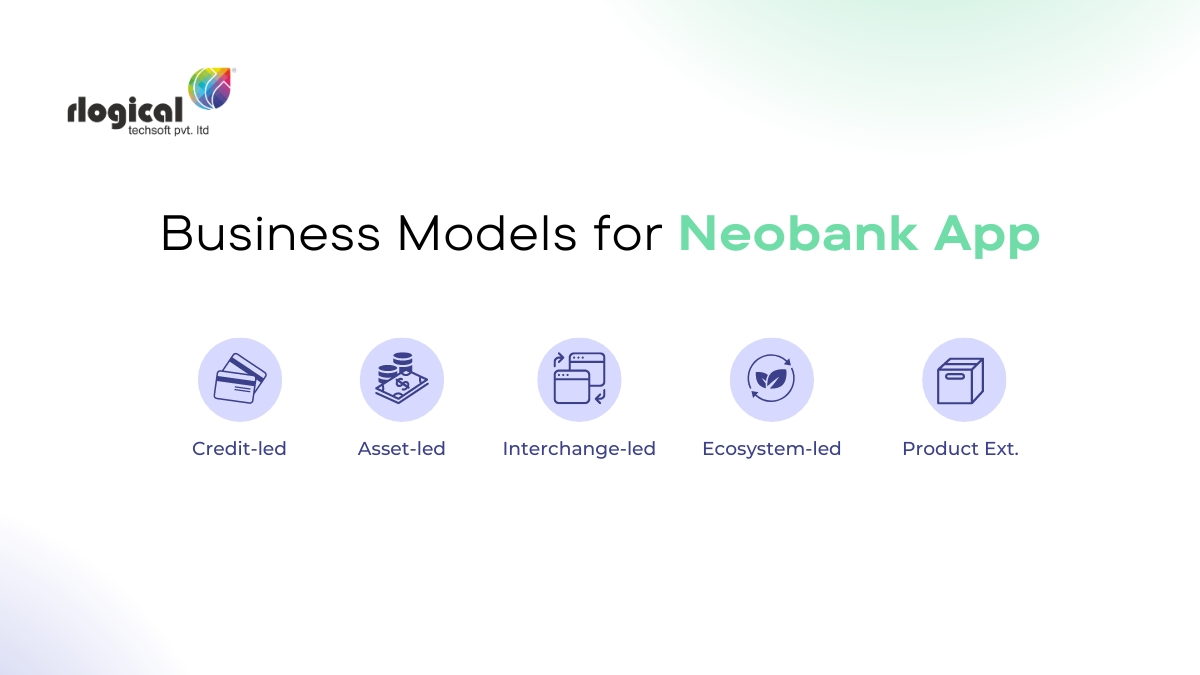

What are the Major Business Models for Neobank App?

Starting any business necessarily requires you to make a vision of the do’s and don’ts of the process. In the highly competitive market, you need to determine your Neobank business model. It helps you take a great leap among competitors. So, here is the best business model to choose from. Make the ideal choice to begin your journey towards leading the Neobanking app.

-

Asset-led

The asset-led business model permits Neobank to provide high-yield savings accounts. Additionally, you will also get certificates of deposit (CD). It makes Neobank become part of the consumer banking market and earn profit accordingly.

-

Credit-led

The credit-led model provides Neobanks users with credit cards at predefined transaction charges. Moreover, it works as a credit line to serve users’ payments through credit transactions. Bank earns money via interest rates.

-

Interchange-led

Interchange-led model is primary focus on making money through transaction fees. It is charged for every monetary transaction and payment through an ATM.

-

Ecosystem-led

It is an indirect method that exposes other monetization strategies. For example, providing budget tools, investment recommendations, etc, influences users’ financial decisions. It makes them perform transactions accordingly. Hence, it is an effective way to communicate with users and increase their engagement.

-

Product Extensions

The product extension model concentrates on eliminating the limitations of banking solutions. It offers other financial products including insurance and loans. So, it makes your Neobank a one-stop solution for multiple financial aspects.

Now, let’s begin with some well-established Neobank apps from all over the world.

Top 7 Successful Neobank Apps Worldwide

-

Revolut (UK)

Revolut is the ongoing and famous Neobank application in the UK. It has a vast number of users onboarded from worldwide. You can swiftly open your account. It manages intelligent money and offers numerous services. Furthermore, it calculates your spending and savings from the transaction history. Users can leverage streamlined payment solutions, rewards, good interest rates on savings accounts, etc.

-

Chime (USA)

Chime is a well-known Neobank in the United States. It earns by following an interchange-led business model. Besides that, it has millions of users who are regularly using the banking services from Chime. The reasons for being the first choice for US citizens are;

- No monthly fees

- Quick access to paycheck

- Fee-free overdraft

- No-charges on ATMs

- High-yield savings accounts, etc.

All-in-all it is quick assistance for users to manage banking solutions remotely. You can easily get account opening, fund transfers, and earn rewards. Chime offers every aspect at your fingertips.

-

N26 (Germany)

With over 5M+ downloads on Play Store, N26 is another great example of a Neobank app. It offers users to open a bank account and manage facilities. The user is not liable to pay any charge for using the service of N26. Additionally, N26 tracks users’ spending habits and expenses on a real-time basis. The app also suggests a proper budget plan. So, you can measure and control unnecessary expenditures. It is covering millions of users from the Europe market.

-

Varo (USA)

The Varo app is an all-digital banking solution. It provides saving, credit, and even cashback on transactions. Furthermore, some of the primary services that users get from it are;

- Contactless debit cards

- FDIC-insured deposits

- Cashback & rewards

- Free fund transfers

- Other money-growing solutions

Hence, the Varo app is rated 4.7 for offering a range of services. It also gives users easy control over their finances.

-

NuBank (Brazil)

NuBank has more than 40 million active users. Being the credit-led model, its key facility that entices the customers is a credit card. You can issue a card at minimal charges for each transaction. It has gained vast popularity among users and marked 100M+ downloads in the Play Store. Because it has been built to eliminate the complexity of traditional banking operations.

Accordingly, its features are defined to maintain your control over finances. You will get to open a digital account, credit cards, loans, investments, etc, facilities. It ensures to maintain your financial goals efficiently. Therefore, it is a renowned Neobank that delivers high customer satisfaction.

-

Monzo (UK)

Monzo is a UK-based fintech solution. This Neobank provides digital banking facilities. It allows you to purchase insurance policies, manage spending, borrow, travel expenses, and many more. However, it offers users monthly subscriptions. The subscription feature works as a major monetization factor for the bank. You can handle your finances smartly and effortlessly with the Monzo app.

-

Klarna (Sweden)

Klarna is a popular Swedish Fintech enterprise. It has been built to facilitate online payments for the shopping of users. The app users can split their post-purchase payments. Consequently, they can pay interest-free installments within the predetermined time. So, users find it easy to manage their big bill payments. Users can also get rewards and earn prizes as referral earnings. Moreover, Klarna is the perfect instance of a Buy Now, Pay Later (BNPL) application.

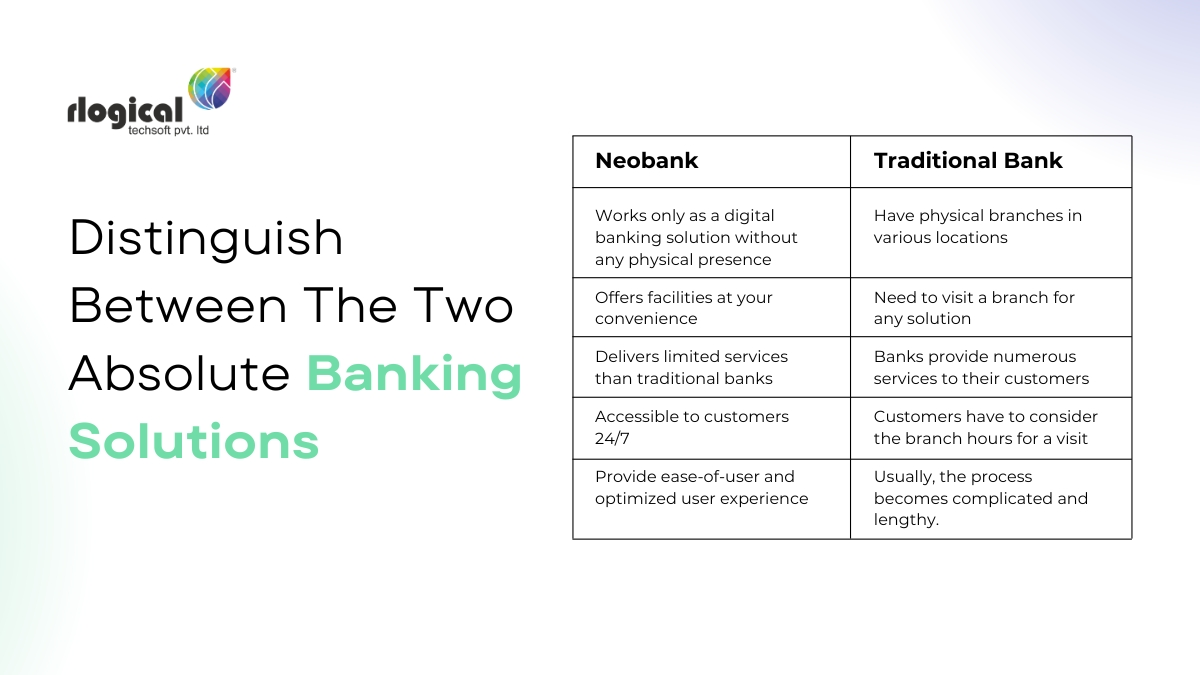

Neobank vs Traditional Bank: Distinguish Between The Two Absolute Banking Solutions

The idea of developing the Neobank app requires you to stay informed about the overall concept. So, the market scenario of traditional banks is also a crucial consideration. For better clarity, we have differentiated Neobanks vs banks from various components. Let’s have a look at them.

4 Amazing Benefits of the Neobank App

Moving forward to the advantages of Neobank apps for customers. There are enormous benefits of Neobank. It delivers an optimized user experience. So, here are some of the benefits that make the Neobank app. It improves your app to plan long-term goals.

-

Ease of use

The supreme requirement of every banking app is to provide easy-to-use functionality. Neobank prevents the implementation of complicated redirections that confuses users. Hence, neobank makes your app deliver comfort and convenience while using banking services.

-

Accessibility

Develop a robust Neobank app that efficiently works on any browser with an internet connection. It is important to have an app that is actively working 24/7 remotely. Being a digital banking solution without any physical branch Neobank is quite accessible. It incorporates quick access on any mobile device.

-

Optimized User Experience

As you can access services on your mobile, it provides a better customer experience. It saves time from lengthy processes, paperwork, waiting queues, unnecessary formalities, etc. So, customers can enjoy services effortlessly at their homes. Just open your account and manage your finances easily.

-

Minimum Operating Cost

The total operating cost of Neobank is lower as compared to traditional banks. After all, it doesn’t set up branches in physical locations. So, the cost of the property for a bank turned out to be savings. However, owners can invest in them for branding and marketing purposes. It is important to boost ROI.

What are the Notable Features of the Neobank Mobile Application?

Now, to start your Neobank application, you need to figure out the required features. Here is a detailed insight into the features. To create a leading-edge Neobank app you shouldn’t miss out on it.

-

Biometric Technology

Neobank apps are making their security factors with biometric technology. It is the latest accepted security measure among the recent generation. As a result, the biometric features manage access to your bank account and increase authenticity. It allows only the respective account owner to unlock the banking service. The authorized person can unlock it through fingerprint, facial recognition, or voice recognition.

Furthermore, it overcomes the drawbacks of passwords or PINs. Because they can be suspected to get hacked. Therefore, Neobank with biometric technology provides higher security to their customers.

-

Real-time Transaction Management

Develop a Neobank app with the feature of managing transactions digitally. You can oversee the transaction history and statements on your mobile. It fetches real-time transaction details to keep track of transactions. On the other hand, this feature performs efficiently for making transactions and eliminating the manual entries in your passbook.

-

Fraud-detection

Neobank should necessarily encompass features for detecting fraud and malware. It works as an extra layer of security to detect any suspicious activity. So, it notifies the user and asks for permission for the activity. Also, users can detect location, device, and network in real time. Hence, it keeps users to remain assured about their online banking and account management.

-

Push-notifications

Enabling push notification characteristics in your Neobank application. It deals to connect with your user efficiently. Your Neobank application should interact with customers in a periodic manner. It is an appropriate way to make your customers update their accounts. From transaction history to other important information, it notifies details and gains their trust. Hence, it makes users know and recognize your bank name and services.

-

Chatbot support

Creating a Neobank app with a chat support feature is an essential feature. It benefits users to ask for any query and account-related information quickly. Integrating chatbot support in your app makes users and new visitors to directly contact you. So, offering 24/7 assistance increases the chances of conversions. As a result, it delivers an optimized user experience. Moreover, chat support also assists to guide customers about the services of the app and any handling issues (if any).

-

Multiple Payment Options

Neobanks have revolutionary features of providing multiple payment options to users. Peer-to-peer payments (P2P), Account-to-Account (A2A), etc, are payment options. It advantages you with smooth and secure solutions. Giving freedom to customers in selecting the payment method increases their trust in your Neobank app. However, it allows them to use banking services from their comfort zone. It streamlines their options for sending and receiving money rapidly.

-

Gamification

Currently, people are more likely to consider the visual elements of the app. The gamification procedure is a proficient feature in better interaction. It boosts your customer satisfaction. Adding game-driven elements like jackpots to the Neobank app development. Your non-gaming app gets the edge of gamified and movable icons. Therefore, you can make your app appealing to customers. It increases their engagement in the long run.

-

E-wallets

Today, every fintech application is linked with e-wallets well in advance. Providing e-wallets is best suited for effortless payment solutions. It securely manages any type of payment. With executing your e-wallet linked with your account you can manage your finances.

Neobank app development with e-wallet functionality makes a great impact on business. It has the potential to retain users and utilize apps for online transactions. There are a few anticipations of cryptocurrency wallets to develop Neobank applications. So, it will be beneficial for now and forever.

-

Card Management

The card management features permit account holders to manage their debit or credit cards through the application. Customers can activate or deactivate it whenever they want. Additionally, customers can handle and set spending limits, renew cards, receive notifications, and so on.

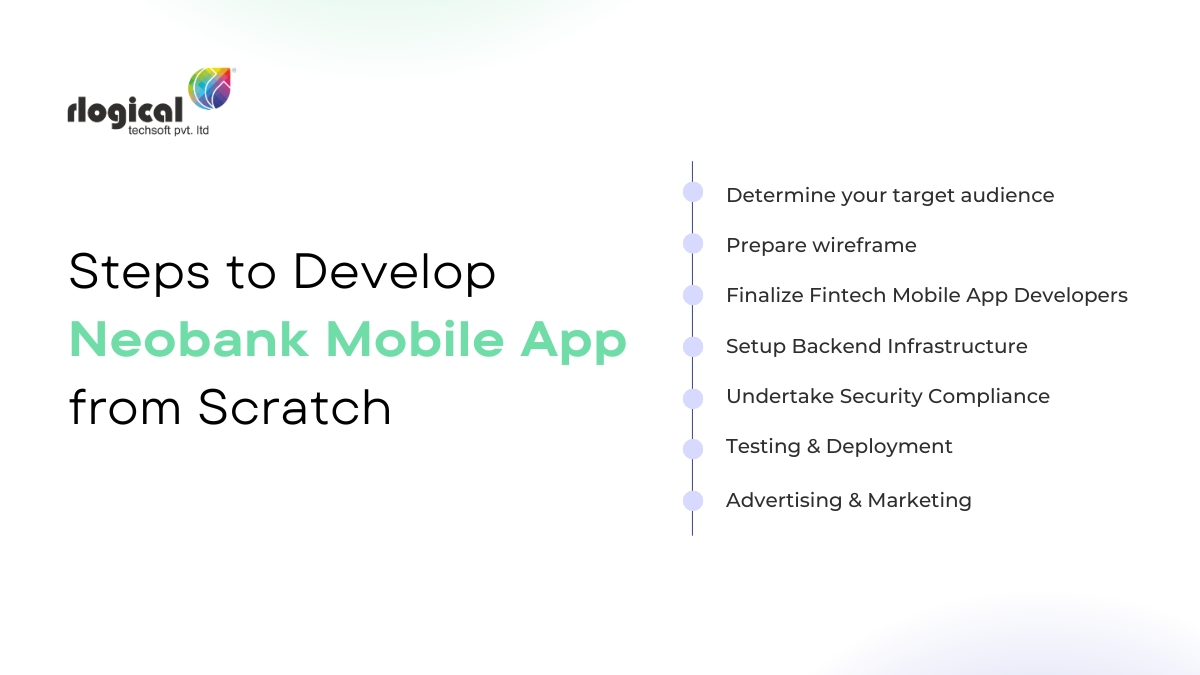

How to Create a Neobank App: 7 Steps to Develop Neobank Mobile App from Scratch

Building your Neobank app requires an all-around practical approach. You need to undertake numerous tasks and decisions. So, here are the 7 steps to create a Neobank mobile app from scratch. It will guide you to build desired Neobank app in less turnaround time proficiently.

-

Determine your Target Audience

Have you any idea who you’re targeting? Neobanking app is a fintech enterprise that focuses on the fintech market and customer category. It is essential to promote among the audience who use smartphones for online transactions. Many people misconception about Neobank as a traditional bank, but that’s not the case. The customers and market of Neobank are quite different from conventional banking.

Hence, perform market research and list out the current trends, tastes, behavior, etc of your target audience. So, you can better evaluate the factors that affect your Neobank app development process.

-

Prepare Wireframe

After having your requirements clearly mentioned, it’s time to make your Neobank app wireframe. It is a sort of blueprint of all the elements to be integrated into the app. Wireframing includes deciding upon computing language, databases, features, APIs, operating systems, responsive, etc. aspects. Therefore, you need to hire professionals who assist you in making robust app wireframes.

-

Finalize Fintech Mobile App Developers

Even after having a solid wireframe, you need to hire Fintech app developers. Expert app developers can execute the app development process. It is the most crucial step to finalize your Fintech app developers. Therefore, consider their past experience and knowledge. It assists in making a calculative decision to build a feature-rich banking app.

You can also hire a dedicated development team to build your Neobank application. The dedicated resources are cost-effective though. It delivers projects faster as per your requirements. As soon as you get the right mobile app developers, you can move ahead with the development process. Building an MVP is advisable to test your idea and its performance.

Pro tip: Try to look and choose mobile app developers that have industry knowledge and worked on banking projects earlier.

Must Read: How to Hire Full Stack Developers?

-

Setup Backend Infrastructure

Establishing a backend infrastructure is noteworthy for the app development process. It helps in carrying out all necessary activities of the application. Now, to deliver a seamless user experience, your Neobank app should furnish the core development solutions;

- Integrating APIs for payment gateways to your Neobank

- Card processing for debit/credit transactions

- Tool to maintain daily banking operations

The application should incorporate personalized functionality and a remarkable UI. It is among the required components to look for. Thus, it needs to be implemented during the development stage.

-

Undertake Security Compliance

Subsequently, the team of developers should undertake security measures. While creating a banking app, maintaining and securing customers’ data in the app is a major concern. You need to build a robust app to prevent any cyber-attacks. Making the Neobank app secure and reliable is turnkey to success.

So, you should determine controlling security regulations for your application. The key strategies include PCI DSS Compliance (Payment Card Industry Data Security Standard), Payment Tokens Generation, and so on. Consequently, it makes your app highly secure and scalable for users.

-

Testing & Deployment

The process of app development can be proven successful after troubleshooting and debugging errors. By automating the app testing process, you can complete quality testing. The testing of your Neobank application is categorized according to the following series;

- Security testing

- Performance testing

- Speed testing

- User acceptance testing (UAT)

Moreover, the testing process is not just part of the pre-launch of an app. It is a constant process that should be driven after the app launch of the application. This way, even after deployment, the app is well-maintained. On a timely basis the new version upgrades, add-ons, integrating advanced features, etc, will enhance the performance.

-

Advertising & Marketing

Lastly, initiate the marketing of your Neobank app after the launch. The purpose of building the app is to onboard users. By performing digital marketing, customers can know about your application. It begins with getting customers on your application.

Furthermore, it is the best result-driven way for your app. It ensures to build your Neobank application to rank among the top SERPs. In addition to that, you can also boost engagement through social media marketing.

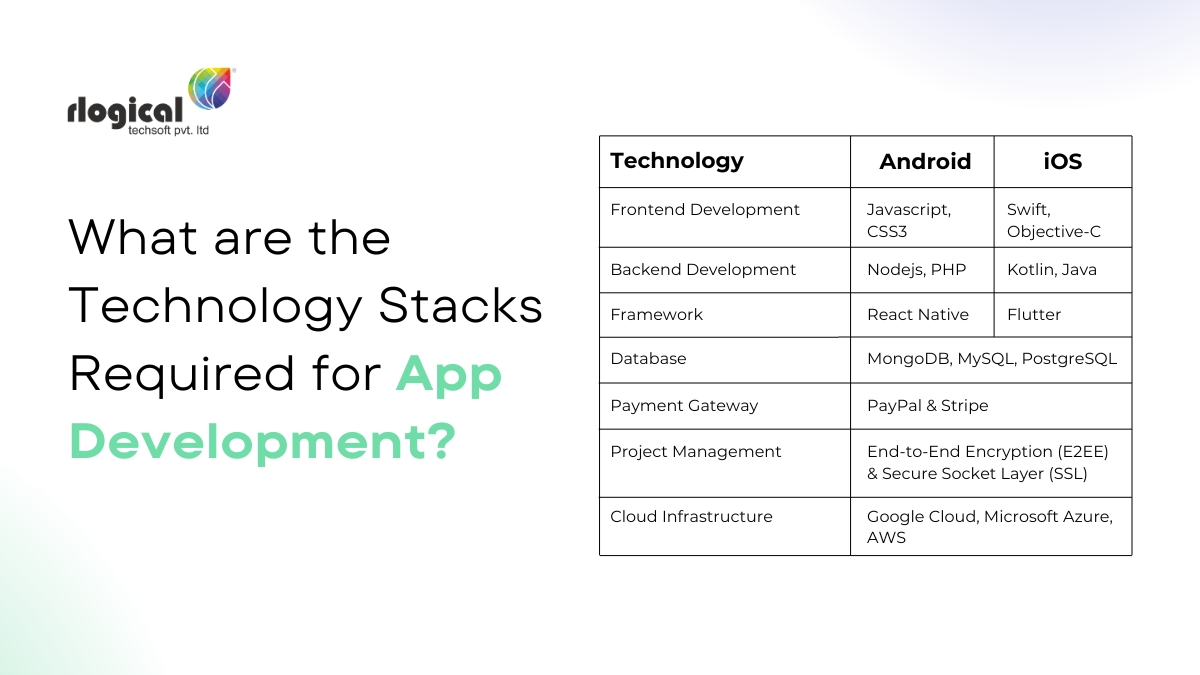

What are the Technology Stacks Required for Neobank App Development?

After understanding the steps to develop a Neobank mobile app from scratch, let’s move to the technology part. It is equally important to determine the essential technology stack. The right technology is implemented in your app development process to ascertain the success rate. So, here we have listed out the tech stack requirement for building your cross-platform mobile app.

What would be the Average Cost to Develop a Neobank Mobile App?

The Neobank development cost can be demonstrated by analyzing various factors of the development process. Such as;

- Features you wanted to integrate into the app

- The country of hiring developers or development team

- The platform you are choosing [Android, iOS, or both]

- Targeted location of the app

Now, after evaluating these factors you can make a budget-friendly deal on creating your banking app. However, the estimated cost to develop a Neobank mobile app would range from $30,000 to $2,50,000.

Bonus Tip: You can find more accurate and cost-effective mobile app developers from India. It has resources at a lower price than the USA. Get a FREE estimation of your Neobank development cost!

How does Rlogical Techsoft Assist you?

After guiding through the above information, you might have got an insight into the Neobanking apps. As a result, it is indeed a profitable business idea for any entrepreneur in 2024 and the upcoming years. It is the next-generation fintech solution to streamline banking operations with immense security. Being among the banking app development companies in India, we have ensured to deliver value-added services. So, it leads to long-term client relationships.

Still, if you are confused about how to develop a Neobank mobile application, we are here to help you! Rlogical Techsoft has experience in developing robust mobile apps for various industries. Additionally, our domain expertise developers make sure of UI/UX, API integration, building MVP, etc. Our developers will assist your Neobank projects to stand out with an attention-seeking app setup.

The Bottom-line

Believe it or not, Neobanking is the future of the banking sector. It has the potential to overrule traditional banks easily. For making a successful fintech business, starting with Neobank app development is the need of an hour.

So, your wait time is over, and it’s the moment to take action. You can build a futuristic app for your fintech startup! Hire mobile app developers and take a step ahead in developing your cutting-edge application!

Jatin Panchal

Jatin Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. For more than a decade, he has been fostering the organization's growth in the IT horizons. He has always bestowed personalized approaches on .NET, PHP, Flutter, and Full-Stack web development projects. From startups to large enterprises, he has empowered them to accomplish business goals. By delivering successful industry-driven solutions, he is encouraging the capability of AI, ML, blockchain, and IoT into custom websites and hybrid mobile applications.

Related Blog

- A Complete Expert Guide on Mobile Banking App Development

- Mint is closing: Develop a Budgeting App like Mint to Attract Gen Z Users

- What is the Cost to Develop an App Like Chase - Business Model & Tech Stack

- A Guide To Understanding Fintech Software Development

- How to Build a Buy Now Pay Later App Like Klarna?

Categories

- All

- AI Development Services

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Grocery App Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Jatin Panchal in Fintech

Jatin Panchal in Fintech