Mobile payments are the next generation that thrives on the concept of cashless transactions. There are some apps today that people can put on their phones and go for mobile payments. The modern-day customer has embraced the convenience and safety that mobile payments bring to the world. It is, therefore, only understandable that retail and ecommerce businesses that are directly customer-facing are shifting to mobile payments.

Mobile payments have brought in a sphere of possibilities that were otherwise not available to companies. The ease of mobile payments is helping businesses grow. This article explores the possibilities that mobile transactions have unlocked for businesses and customers.

The ease of online mobile payments

The ease of tapping away and conveniently buying things motivates buyers to purchase more goods because of the ease of access. Businesses can capitalize on this sentiment of the modern consumer and increase the chances of more Business with direct customers. Even organizations prefer the mode of mobile payments for their transactions for the security that they offer. Mobile payments are a dynamic sphere that present-day companies are starting to develop. Therefore, new ventures need to tap into a mine of possibilities. Mobile payments go hand in hand with the expansion of mobile commerce.

The growth of mobile possibilities

Today, one individual carries more than one mobile device. When you look into family dynamics, several devices exist within a family. Today, mobile payment solutions are easy to use and occur within devices. Over 500 million mobile payment customers have been added to the scenario in the last decade. In the coming decade, the number will only go up.

Every sector is trying to capitalize on the opportunity, from retail to mobile companies. The advent of financial technology has only propelled mobile payment solutions into a sphere where they are a part of regular life. The payment and banking industry has diversified from dedicated mobile apps to built-in mobile solutions that store your financial and card details for instant payments.

Rapid application of innovation

The innovation pace for such solutions is very high. Even social media platforms that have already leaped into the online marketplace are integrating mobile payment solutions so that customers can shop from different brands in one place. The convenience for the customer and the ease of Business for brands is enhanced in this way. Social media giants like Meta, Instagram and other platforms are investing in mobile payment options to gradually explore this possibility.

Retail stores, online stores and fast food joints that operate globally have acted as pioneers of mobile payments today. Apart from mobile to mobile payments, contactless card payments are a part of today’s payment landscape. Quick service outlets are the pioneers of the payment method as the focus has always been customer convenience.

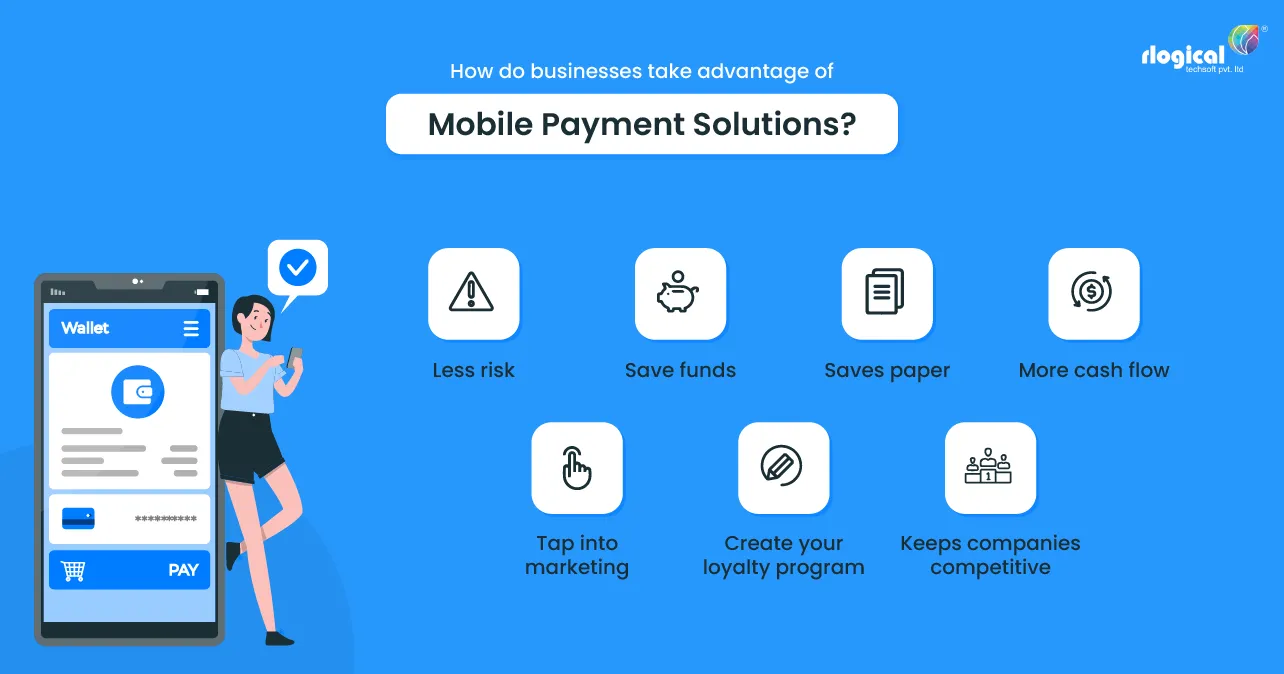

How do businesses take advantage of mobile payment solutions?

The advantages your Business draws from contactless mobile payments depend on your business type and model. For retail outlets, the mode of mobile payments ensures that there are more purchases. No more excuses that the customer has left his purse at home or that he does not have enough cash in hand. Customers often do not reflect on their bank balances before spending if they do it through a mobile app. The easy method that comprises simple taps and steps is a bonus for the company. Here are how mobile payment methods help businesses thrive.

More cash flow

Cash flow is very important for the overall interface of the Business. The online payment method via mobile phones is a quick way of gaining funds. The funds are credited to the company account within 3 to 5 days when the overall payments are made through a mobile device. This ensures a steady cash flow toward the company account, and the company can immediately use the funds for its operations. When there is enough cash, the company can make instant payments and keep things going for the workflow. The company also gets many cash discounts through this method. The cash flow ensures that the company stays functional and highly motivated toward its goal.

Less risk

There is, of course, less security risk for the customer as he can do the transactions himself with a trustworthy app. The money does not change as many hands as before, and the risk of misdirection or loss of funds is very less. The payment happens between the customer and the company. On the other hand, the risk for the company is also reduced. The company can now ensure that it gets customers’ payments fast and easily through mobile payments.

Customers can no longer escape the payment obligation as even if you do not carry cash, you can make payments whenever and wherever in this world. Companies instantly receive funds, and the risk of pending payments reduces. The threat of fraud and theft reduces both customers and companies equally. The advantages simplify the payment process for companies to focus on other areas.

Save funds

The company also streamlines its marketing and sales by enabling mobile payments from the customer. The funds spent on funding collection are saved as the company does not have to spend money convincing people to pay or collect payments. Earlier, companies used several tactics like sending an executive to gather customer funds. Now, they do not have to send individual executives to gather payments. The saved time and funds are used to do other things that are more necessary for the company. It is not judicious to focus on simply one area, such as payments. Other areas are also efficiently managed when the company automates payment processes via a mobile phone.

Keeps companies competitive

Staying competitive in a market space is of foremost importance for companies. The way of mobile payments is a method that people switched to during the pandemic. The adaptability shown by many of the companies has helped them adapt to the market conditions. The pandemic ushered in many social and Business disruptions that have become the norm today. With the help of mobile payments, companies have ushered in the model of paying from anywhere, which gives them a competitive edge.

Other companies that do not yet trust mobile payment solutions suffer from drawbacks. Technological advancement is very important in keeping companies as progressive as the market. If customers update their technology profile with the help of instant mobile payments, the businesses that cater to such customers should also go for such methods. The day is close when every payment will be done on mobile phones. Many customers abandon their cart on the company website only because the option of mobile payments and online transactions is not available.

Saves paper

When the transactions are made online, the receipts are generated in the online mode. The company does not have to use paper to create records and invoices for the payments. The app conveys the payment details; the user can unlock these records whenever necessary. The method saves paper and is environmentally friendly. When businesses are streamlining o make the workflow more sustainable, this change fosters better practices within the company. Although the change will be small, the impact will be big. The electronic data is undisputed and can be created into hard copies when necessary.

Tap into marketing

There are many ways in which mobile payments come in handy to the company. The use of mobile apps for payment can integrate sales and marketing into one platform. You can easily use the platform to promote your brand through coupons and offers. The coupons can extend some users’ benefits and increase the influx of customers and revenue for companies. Email marketing and SMS marketing can be incorporated into mobile interfaces as these are communication tools that users use via mobile phone. This way, companies can enter the mobile phone landscape regarding sales and marketing.

Create your loyalty program

The mobile interface can create and run loyalty programs for your brand. The loyalty program extends certain benefits to the users who frequently use the app. Customers easily redeem points or coupons with loyalty programs to claim discounts and cashback. These are exclusive to the app, so the app is more popular for payments. Many present-day companies are investing in multi-faceted payment apps that can be used for coupon schemes and loyalty programs. The digitization of payments and loyalty benefits helps keep the operational extent broad and opens multiple revenue channels for the company.

There are several ways in which mobile payments can help companies. From opening up new avenues of revenue generation to increasing the number of associated customers, there are many things that companies achieve with the use of mobile payment solutions. Companies must employ innovation and novelty in bringing out payment options that engage the customer and increase revenue. Payment options can be integrated into mobile web site and apps that can be downloaded to phones. The mobile phone is an advantage for the modern customer and companies that cater to his needs.

Rahul Panchal

Rahul Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. He is a pioneer tech enthusiast who has assisted diverse enterprise solutions with a fresh perspective over the years. From integrating technologies like Full-Stack, .NET, Flutter & PHP, he has harnessed custom web or hybrid mobile app development projects. His creative outlook on the latest models of AI, ML, blockchain, and IoT, has made various businesses attain leading-edge success.

Related Blog

- Progressive Web App Development Cost: Accurate Figures Guide

- Top Hybrid App Development Frameworks to Capture 2025 Trends For Your Business

- How Much Does MVP Cost: Factors Influence MVP Development Budget & its Reduction Tips

- Progressive Web App Benefits for Your Business Growth in Future Market

- Flutter for Web App Development: The Cross-Platform Companion For Your Business

Categories

- All

- AI Development Services

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Rahul Panchal in Mobile App Development

Rahul Panchal in Mobile App Development